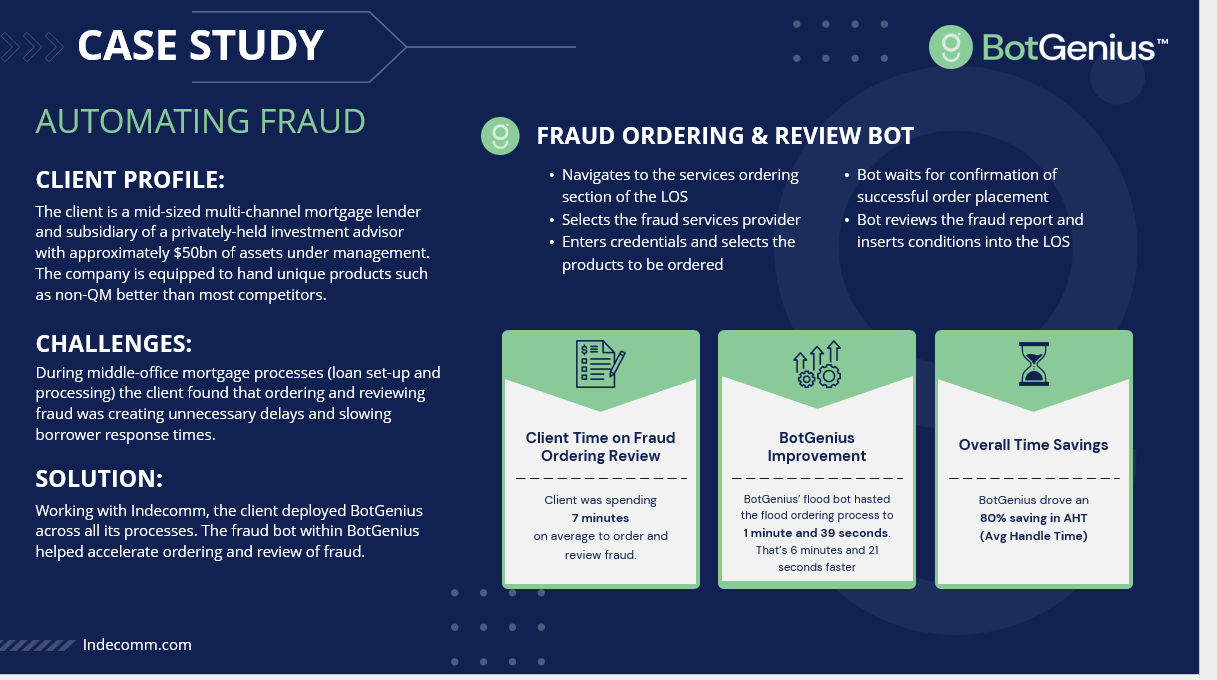

Background: The client is a mid-sized multi-channel mortgage lender, a subsidiary of a privately-held investment advisor with approximately $50 billion of assets under management. With a focus on offering unique products such as non-QM mortgages, the company prides itself on delivering efficient services to its clients. However, during middle-office mortgage processes, specifically loan set-up and processing, the client encountered significant delays and slowdowns in borrower response times due to inefficiencies in ordering and reviewing fraud.

Problem Statement: The client identified that ordering and reviewing fraud was causing unnecessary delays in their middle-office mortgage processes. With manual methods in place, the process was time-consuming and prone to errors, impacting borrower response times and overall operational efficiency.

Solution: Indecomm’s BotGenius “fraud” ordering and review mortgage bot: Working closely with Indecomm, the client deployed BotGenius across all its mortgage processes. One crucial component of BotGenius was the fraud bot, specifically designed to expedite the ordering and review of fraud. The process involved automating the following steps:

- Navigating to the services ordering and selecting fraud services provider in the LOS

- Selecting, ordering, and confirming successful fraud order placement.

- Reviewing the fraud report and inserting conditions into the LOS.

Before implementing BotGenius, the client spent an average of 7 minutes ordering and reviewing fraud. Indecomm’s BotGenius saved the client 6 minutes and 21 seconds per loan.

Key Benefits:

- Significant Time Savings: BotGenius drove an impressive 80% reduction in Average Handle Time (AHT) for the fraud ordering and review process, allowing the client to process mortgage applications more swiftly and efficiently.

- Enhanced Operational Efficiency: By automating repetitive tasks and streamlining processes, BotGenius enabled the client to allocate resources more effectively, reducing manual errors and freeing up staff to focus on higher-value activities.

- Improved Customer Experience: Faster processing times resulted in quicker response times for borrowers, enhancing overall customer satisfaction and retention rates

The Result: Deploying Indecomm’s BotGenius, specifically the fraud bot, drastically improved the client’s processing timelines. With BotGenius, the fraud review and ordering processes accelerated significantly. The fraud ordering process was completed in just 1 minute and 39 seconds, representing a time savings of 6 minutes and 21 seconds.

By significantly reducing the time and effort required for ordering and reviewing fraud, the client achieved notable improvements in operational efficiency and customer experience. With BotGenius, the client is better equipped to handle unique mortgage products and serve its clients in a competitive market landscape.