Solutions

I AM A

I NEED

Company

Solutions

I AM A

I NEED

Company

AuditGenius QC software can be set up for many different workflows, with an unlimited number of audit types and checklists.

An integrated machine learning platform reduces time needed to complete document reviews.

AuditGenius pinpoints defects and identifies the root cause for errors, tracked by individual and by category.

Quality review audits are linked together in the pipeline to manage risk with a holistic view across the mortgage operation.

AuditGenius delivers a wide array of standard reports and users can also create customized reports when needed.

Interactive, dynamic dashboards give you a snapshot of QC results with detailed drill-downs for key operational insights.

AuditGenius is configured with business rules and checklists aligned to GSEs, investors, and internal QC requirements, helping lenders meet investor, agency, and regulatory audit standards across unlimited audit types.

Yes, lenders see an estimated 50% reduction in manual processes and time spent on pre-fund audits, along with significant reductions in redundant QA and spreadsheet-based reporting.

Prefunding, Post-Closing QC, Adverse Action, Early Payment Default, HMDA, MERS Audits, Pre-Purchase, Due Diligence, Servicing QC, Mortgage Insuring, and more!

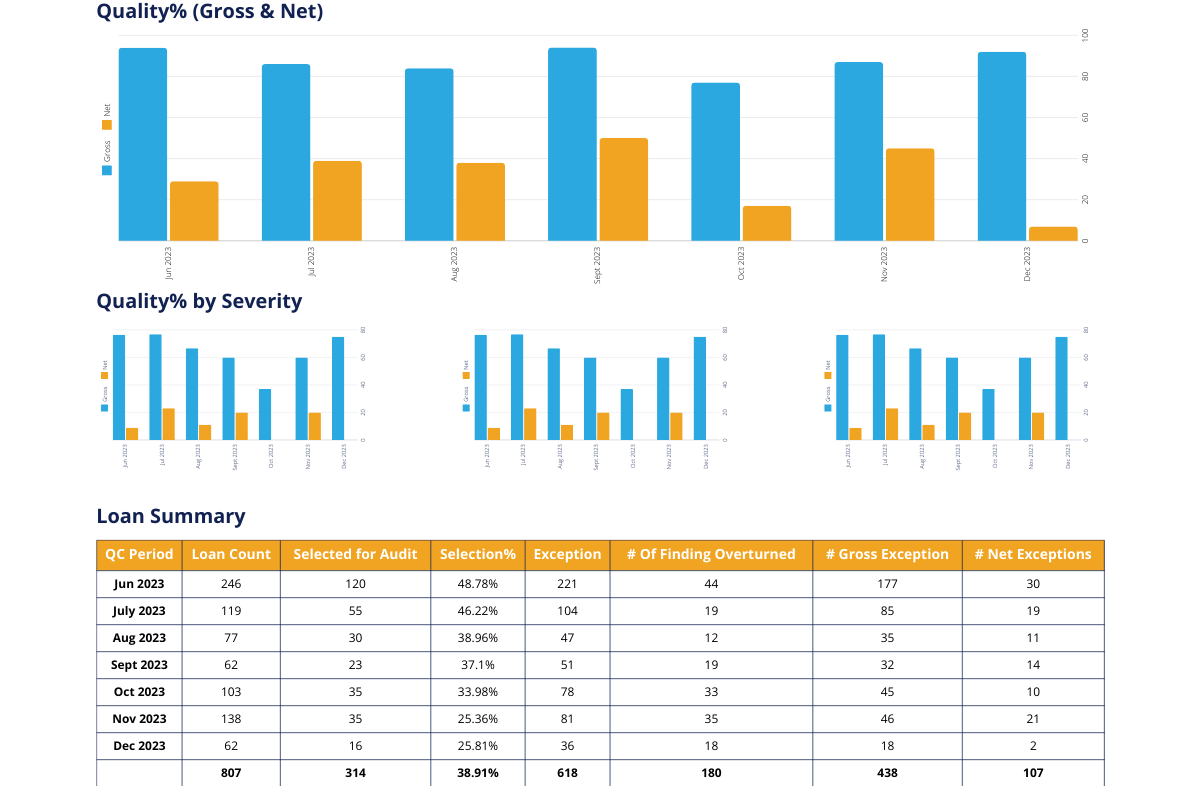

AuditGenius has a robust reporting suite with interactive visualizations, including a Quality Trend dashboard.

AuditGenius offers automated workflows, which removes may tasks from your team. Additionally, we are happy to discuss outsourced audit resources as a service.

Yes, standard AuditGenius workflows include a self-service checklist module that allow you to update your own checklists on your own timeframe.

Yes, AuditGenius has a robust re-verification tracking module as well as reporting.

Yes, AuditGenius has a pre-built dashboard to keep you in compliance with agency minimum standards for post-closing QC.

[ninja_form id=2]