AI and Automation: The New Operating Rhythm for Mortgage Lenders

The mortgage industry is at an inflection point. Rising origination costs, shrinking margins, and heightened compliance pressures have pushed lenders to rethink traditional workflows.

Solutions

I AM A

I NEED

Company

The mortgage industry is at an inflection point. Rising origination costs, shrinking margins, and heightened compliance pressures have pushed lenders to rethink traditional workflows.

Brent Jeanetta, Manager of Client Success and Automation at Indecomm, blends mortgage expertise with a tinkerer’s mindset to turn complex workflows into practical, reliable automation.

Technology and AI projects in mortgage operations often start with excitement: shiny new tools promising faster turn times,…

As VP of Automation and Client Success at Indecomm, Joy Gilpin leads the implementation of several of the company’s Genius suite of technology solutions—including AuditGenius and DecisionGenius.

Climbing the digital transformation mountain isn’t easy. But mortgage lenders are making their ascent—one intelligent workflow at a…

Meet Narayan Bharadwaj, Executive Vice President of Automation at Indecomm—a technologist, strategist, and relentless advocate for pragmatic innovation in the mortgage industry.

Everyone loves a summit photo. But few think about the sore legs, tedious training, or carefully charted routes it took to get there.

The same holds true for AI and automation in the mortgage industry. As lenders and servicers eye the peak—cost savings, scalability, risk reduction—it’s easy to get caught up in the excitement of transformation and forget the climb starts at the base.

Homebuyers in 2024–2025 are thinking differently—and it’s changing the game. With high interest rates, inflation, remote work becoming the norm, and tech evolving fast, people are making decisions in new ways or avoiding making decisions altogether. For mortgage lenders, that means it’s time to shake things up: get tech-savvy, stay flexible with products, and rethink how to manage risk. Here are a few notable points that may impact lender operational decisions in 2025.

Rachael Harris knows mortgage operations – because she’s lived them. With over 20 years of hands-on experience and a no-fluff approach to product development, she’s built her reputation on delivering mortgage SaaS and automation products that makes a real difference.

With Indecomm’s Post-Closing Hub, cycle-driven disruption doesn’t have to lead to bottlenecks, compliance issues, or repurchase risks. The Post-Closing Hub delivers consistency in a stage of the process that’s too often reactive. Whether you’re managing a few dozen loans a month or several thousand, the model flexes—keeping timelines tight, quality high, and your team focused on what matters most. Because in today’s market, a stable post-closing process isn’t just a nice-to-have—it’s a strategic advantage.

The homebuying journey is filled with emotion—hope, stress, anticipation. What borrowers need most is someone who can cut through the noise, answer their questions quickly, and keep them moving forward with confidence. But far too often, the people best equipped to provide that experience, such as your mortgage processors, are buried in routine digital data tasks. The time-drain is anything but modern.

“You can’t fix what you can’t see.” That’s the quiet truth lurking behind too many Quality Control (QC) departments in mortgage lending today.

All too often, QC data stays locked in spreadsheets, siloed from the teams that could act on it — origination, underwriting, processing, post-closing. But Premium Mortgage shows us what happens when you flip the script:

Imagine walking into a library where books are scattered everywhere—no shelves, no categories, just a sea of documents….

Automation and AI in underwriting is no longer a luxury—it’s an industry imperative. With rising demand for efficiency, reduced costs, and better customer experiences, automated underwriting systems (AUS) have taken center stage. Yet, navigating the process of selecting and adopting the right system can feel overwhelming. We’ve simplified it for you.

This, friends, is the mortgage industry’s document problem. It sounds like a minor inconvenience—something technology should have solved a decade ago. But here we are. At Indecomm, we’ve spent the last year digging into why this is still happening. The answer? While many vendors promise automated solutions for document indexing and data extraction, most fall short. Until now.

By focusing on efficiency, accuracy, and ease of use, Indecomm’s Automated MERS Audit solution is an indispensable tool for lenders looking to streamline their compliance efforts. With this blog, you can clearly convey the value of the solution to potential clients, encouraging them to explore how Indecomm can simplify their audit processes

Beyond the timeliness of mortgage document delivery, issues with loan package quality can threaten the foundation of your post-closing operations. Rest assured, tackling trailing doc tracking is a non-issue with the right mortgage document technology.

Without adequate support, staying abreast of guideline changes, best practices in loan review, and ensuring compliance with new requirements becomes increasingly challenging, leaving mortgage companies vulnerable to fines and penalties.

In a marketplace filled with numerous mortgage BPO providers, it becomes crucial to distinguish those that genuinely add value. What are the most important features of your BP partner? How do you determine whether your partner is an ally, advancing your interests, or simply focused on keeping your organization reliant on FTEs?

As the buzz around declining mortgage rates begins to swell, lenders and servicers are facing a veritable jungle of rate locks, volumes, and customers. Conjuring up the Wizard of Oz, the industry is trekking along its own Yellow Brick Road, where the thrill of increased loan volumes comes with a side of apprehension. This isn’t just about enthusiasm; it’s about readiness and business scalability. When the market returns with volume spikes, the fear of being unprepared can dampen the excitement of growth.

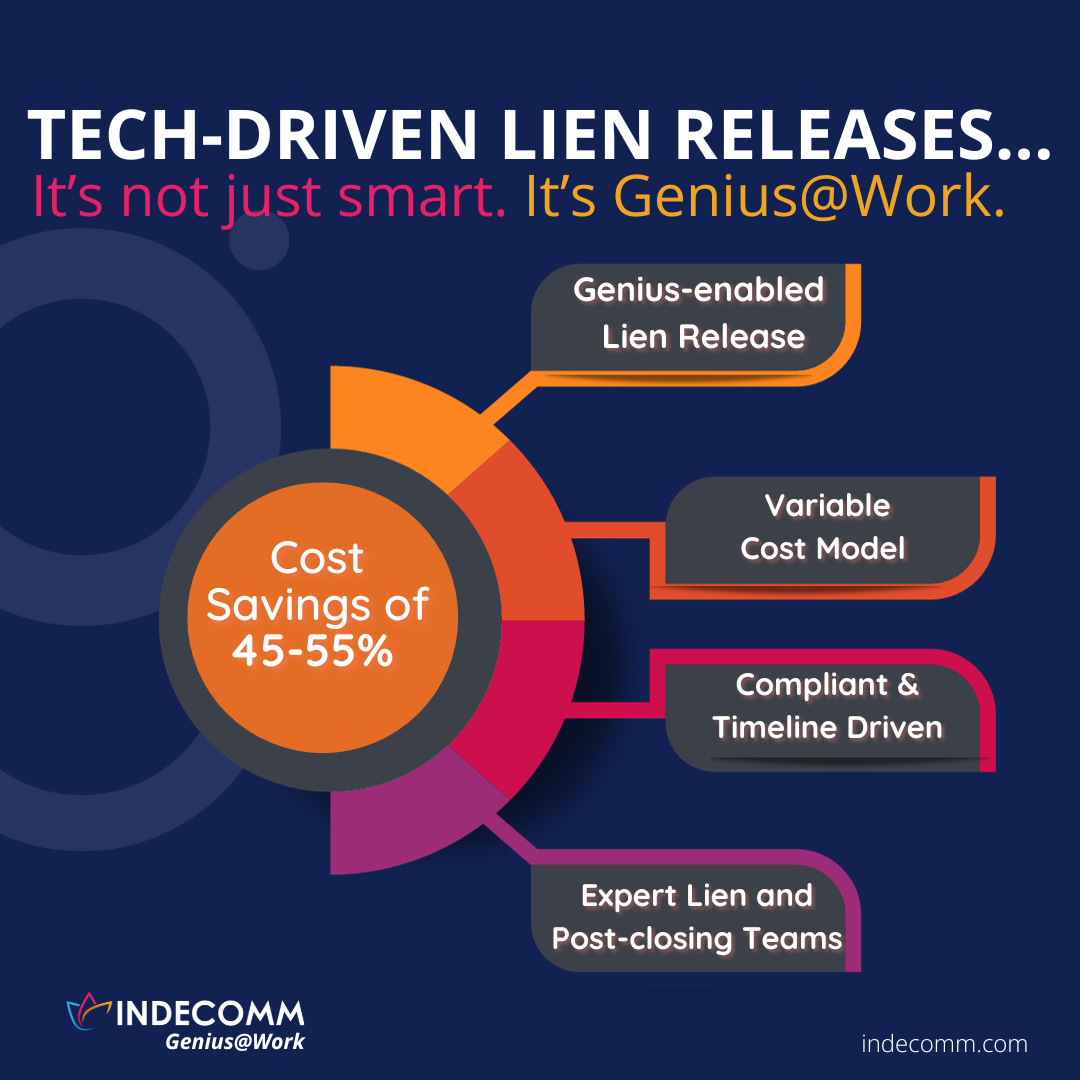

Picture this: you’re in the business of mortgage lending, and you’ve just successfully helped a borrower close on their dream home. It’s a moment to celebrate, but there’s one more task on the to-do list — releasing the lien on the property. Now, you could handle this the old-fashioned way, diving into stacks of paperwork, crossing your fingers, and hoping for a smooth process. Or, you could take a cue from Indecomm’s Genius approach to mortgage operations and simplify.

Enter lien release services – the streamlined, no-nonsense approach to ensuring that all-important lien is released efficiently and in compliance with all the rules and regulations. Here’s how Indecomm can help you cut through the complexity:

By Kevin Quinn, SVP, Servicing

The mortgage market is predictably unpredictable. If you are a mortgage industry veteran, you have ridden the mortgage rollercoaster and watched businesses exit never to return. The truth is that not every firm is cut out for (or designed to withstand) the fast, extreme market change that can occur in the mortgage industry.

The Indecomm mortgage services model gives its partners a pathway to automation and tech adoption. It has flipped the script on the traditional mortgage outsourcing model and prioritized the lender and servicer’s need for a high-tech, automation-enabled services offering.

The mortgage industry’s transformation is underway, driven by the convergence of technology and human expertise. Augmented underwriting emerges as a beacon of change, where automation enhances efficiency, accuracy, and the borrower experience. As lenders navigate this dynamic landscape, embracing augmented underwriting can unlock untapped potential, deliver faster approvals, and secure a competitive edge. But what is it and how does it work?

It may not be science fiction but underwriting a mortgage loan is an epic quest for the truth that involves pouring over hundreds of documents, checking fields, comparing calculations, and often, going over the same file several times.

The Genius-to-Genius forum is committed to helping mortgage businesses better evaluate, implement, and utilize automation in a way that fundamentally changes how they operate and ensures a more resilient and agile response to market cycles.

Shifts in underwriting toward technology and automation are attributed to changing customer demand, mortgage operational burden, and market cycles.

From loan decisioning tools to breakthroughs in machine learning, RPA, and intelligent automation, the tides of digital mortgage underwriting are shifting. Here’s why.

The quality, accuracy, and visibility of data, documents, and analysis backing an underwriting decision are just as important as the final decision itself. Learn how glass-box technology drives Indecomm’s DecisionGenius automated underwriting and loan decisioning accuracy.

When you are a mortgage lender the “market seesaw” effect is inevitable. One minute you are looking at low rates, record volumes, and increasing revenues, trying to keep up with demand. And, the next minute —like this very minute — your volumes are declining, rates are rising, and you are stuck with all the costs you incurred when trying to keep up with production.

Indecomm Appreciates Ambition Indecomm believes in providing equal employment and advancement opportunities to all individuals based on merit, qualifications, and abilities. Through our Indecomm University program, we hire, train, and educate new graduates in mortgage processes, technology, operations, and automation. This program gives aspiring new professionals the opportunity to gain the knowledge and experience required

Indecomm’s genius suite of automation products offers lenders the opportunity to better adapt to changes in the market. Easy to use and easy to implement, the genius suite of products accelerates income analysis, underwriting, document management, and operations. Watch the video to get a quick overview.

Indecomm, a provider of mortgage automation solutions, is pleased to announce the launch of our new website, located at indecomm.com The goal of our new website is to provide visitors with an easy way to learn about Indecomm’s products and services and to keep our customers informed of our latest innovations. The new website showcases

While most loan volumes are expected the shrink in 2022, the non-QM sector is expected to double its market share. Non-QM loan growth is expected to increase by a whopping 40%. Is your operation ready to capitalize on this unique asset type?

After a tumultuous ride through 2021, we are finally now in 2022 with plenty of hopes for better times ahead.

There are many things that loan originators and branches need to know about self-employed customers. Many lenders, even with most conventional pipelines, report up to 40% of their files having tax returns. True self-employed borrowers, borrowers with a side business, borrowers with rental properties…the number of self-employed clients add up. Our clients have heard horror

By significantly reducing the time and effort required for ordering and reviewing fraud, the client achieved notable improvements in operational efficiency and customer experience. With BotGenius, the client is better equipped to handle unique mortgage products and serve its clients in a competitive market landscape.

By significantly reducing the time and effort required for ordering and reviewing fraud, the client achieved notable improvements in operational efficiency and customer experience. With BotGenius, the client is better equipped to handle unique mortgage products and serve its clients in a competitive market landscape.

By significantly reducing the time and effort required for ordering and reviewing fraud, the client achieved notable improvements in operational efficiency and customer experience. With BotGenius, the client is better equipped to handle unique mortgage products and serve its clients in a competitive market landscape.

Top mortgage originator rolled out IncomeGenius to its correspondent partners, improving the accuracy of calculations and reducing repurchase risk. Check out the stats!

The customer saw an opportunity to improve their underwriting workflow by using Indecomm’s DecisionGenius solution. This is an automated solution for loan decisioning and underwriting that seamlessly integrates with the customer’s LOS.

The mortgage application process has long been plagued by manual data extraction and analysis, leading to delays, errors, and escalated costs. This spurred Indecomm, backed by decades of mortgage industry experience, to conceive IDX — a revolutionary tool to automate these intricate tasks.

A mid-size regional lender recently experienced a series of mergers and acquisitions and found different levels of competency in their merged underwriting staff. Indecomm implemented a pre-funding underwriting review to identify opportunities for improvement.

A servicer had a backlog of lien release documents to process plus an immediate need to reduce staffing costs in the lien release department. Leveraging Indecomm’s plan and support, the client realized a 25% immediate cost reduction.

A large lender with outstanding documents utilized Indecomm’s final documents management and DocGenius solution, generating a 15% savings.

A top mortgage lender and servicer acquired a large government loan portfolio. Indecomm developed policies and procedures enabling the client to insure/guaranty over 90 percent of the previously uninsured loans.

A title and settlement service provider needed timely and cost effective recording solutions. Indecomm implemented DocGenius to improve the client’s turnaround times, minimize errors, and improve customer satisfaction.

A leading vendor management client had an immediate need to reduce overhead and staffing costs. Indecomm put in place a team of contract auditors to manage volume fluctuations, allowing the client to attain a low variable cost per order vs. a high fixed cost.

Client Information The lender is a top lender/servicer with a $380 billion servicing portfolio and multiple production channels….

Learn how a top 5 lender leveraged Indecomm’s automated loan estimate & closing disclosure comparison to execute assignments.

Every industry eventually encounters a point where longstanding assumptions break down,

expectations shift overnight, and the operational foundation that once felt stable suddenly

becomes obsolete. Photography had its reckoning with Kodak.

The Automated and AI Underwriting System Selection Guide is designed to simplify the complex process of evaluating, selecting, and implementing a mortgage underwriting system tailored to your organization’s needs. By providing a step-by-step framework—from discovery through contract negotiation—this guide ensures you have the tools to identify the right solution, maximize ROI, and foster team adoption. Whether you’re seeking to enhance efficiency, reduce costs, or improve the borrower experience, this guide equips you with actionable insights to make informed decisions and achieve lasting success.

Discover how to navigate the unpredictable mortgage industry landscape with confidence in the “2024 Mortgage Industry Guide.” This comprehensive eBook explores the ever-shifting dynamics of interest rates and loan volumes, offering a strategic perspective on leveraging Business Process Outsourcing (BPO) as a powerful ally. Learn how to select the right BPO partner by evaluating transparency, industry expertise, quality, real-time performance metrics, and innovation.

Meticulous planning ensures your mortgage automation project’s alignment with business objectives and facilitates smoother implementation, integration, and adoption, ultimately leading to enhanced operational efficiency and service quality in the mortgage process. Download the infographic for six steps to get started with your planning.

In the ever-evolving landscape of automation, where machines seamlessly weave together the threads of our digital world, two formidable contenders step onto the stage: RPA, the nimble acrobat, and APIs, the eloquent communicators. It’s a duel that has left many a curious mortgage mind pondering, “Why RPA and why not APIs?” So, let’s take a moment to embark on a journey to unravel the enigmatic dance of these two automation titans. Find out how mortgage RPA and APIs work together to drive a more seamless operation.

Strategic technology and automation investments in the mortgage middle office will significantly improve productivity and quality in processing operations for mortgage lenders that recognize the opportunity. What defines the mortgage middle office and how can technology help transform this function.

[ninja_form id=2]