Client Information

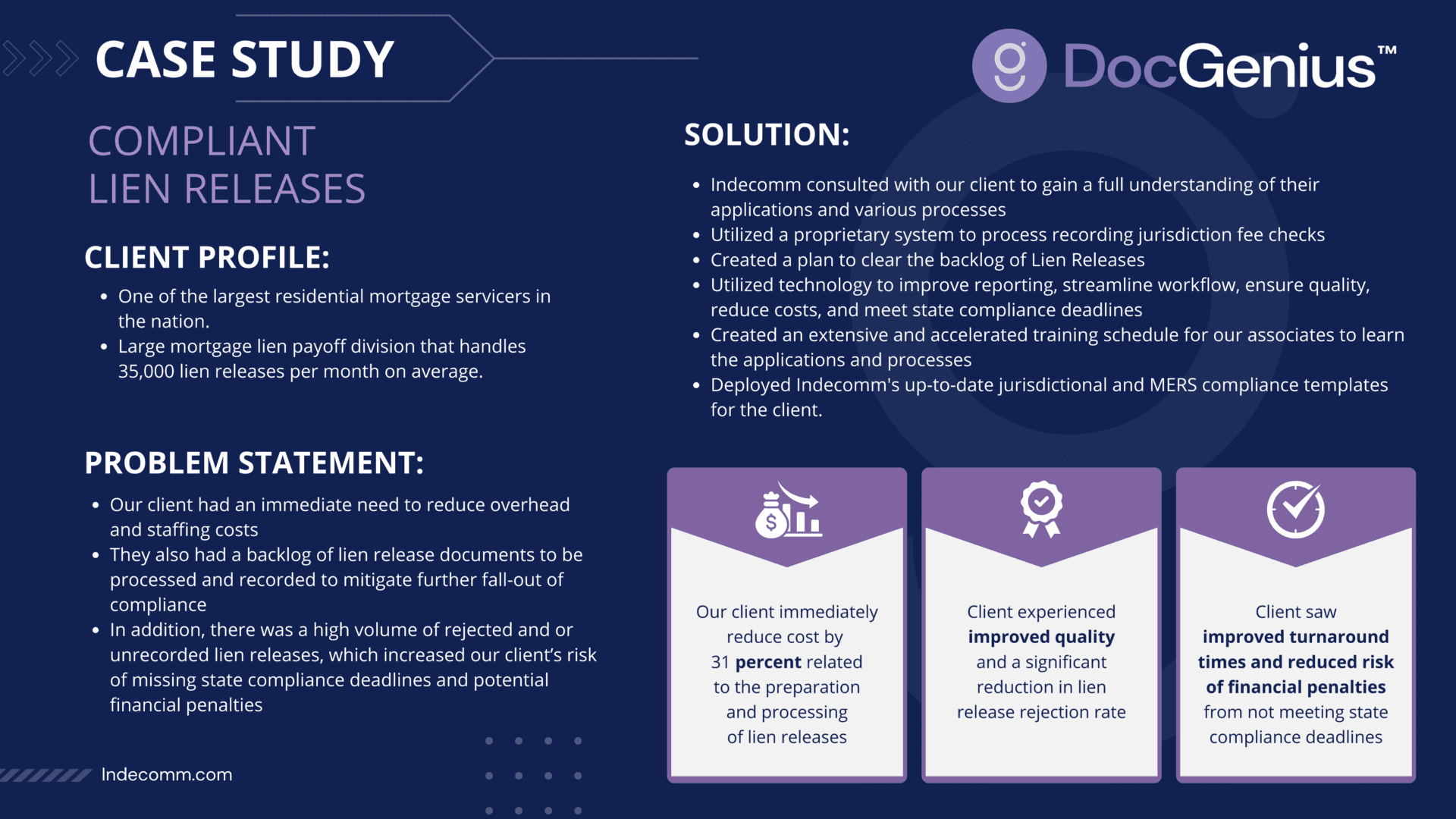

The client is one of the largest residential mortgage servicers in the nation.

Background

The client’s mortgage lien payoff division handles on average 35,000 lien releases per month. Lien Release documents must be prepared and recorded promptly to meet compliance requirements.

Problem Statement

- Our client had an immediate need to reduce overhead and staffing costs

- They also had a backlog of lien release documents to be processed and recorded to mitigate further compliance challenges

- In addition, there was a high volume of rejected and or unrecorded lien releases, which increased our client’s risk of missing state compliance deadlines and potential financial penalties

Solution Summary and Key Benefits

- Indecomm consulted with our client to gain a full understanding of their applications and various processes

- Utilized a proprietary system to process recording jurisdiction fee checks

- Created a plan to clear the backlog of Lien Releases

- Utilized technology to improve reporting, streamline workflow, ensure quality, reduce costs, and meet state compliance deadlines

- Created an extensive and accelerated training schedule for our associates to learn the applications and processes

- Deployed our up-to-date jurisdictional and MERS compliance templates for the client

The Result

- Our client experienced an immediate 31 percent cost reduction for the preparation and processing of lien releases

- Indecomm was able to demonstrate improved quality through a significant reduction in the overall lien release documentation rejection rate

- Indecomm’s client was able to see improved turnaround time, which reduced the risk of financial penalties for not meeting state compliance deadlines

Summary

- A servicer had a backlog of lien release documents to process plus an immediate need to reduce staffing costs in the lien release department

- Indecomm developed and implemented a plan and process to clear the backlog, minimize errors, improve workflow, and ensure lien releases are perfected within state compliance timelines movign forward

- Indecomm’s client realized a 31% immediate cost reduction and met state compliance requirements