Make intelligent loan decisions, faster

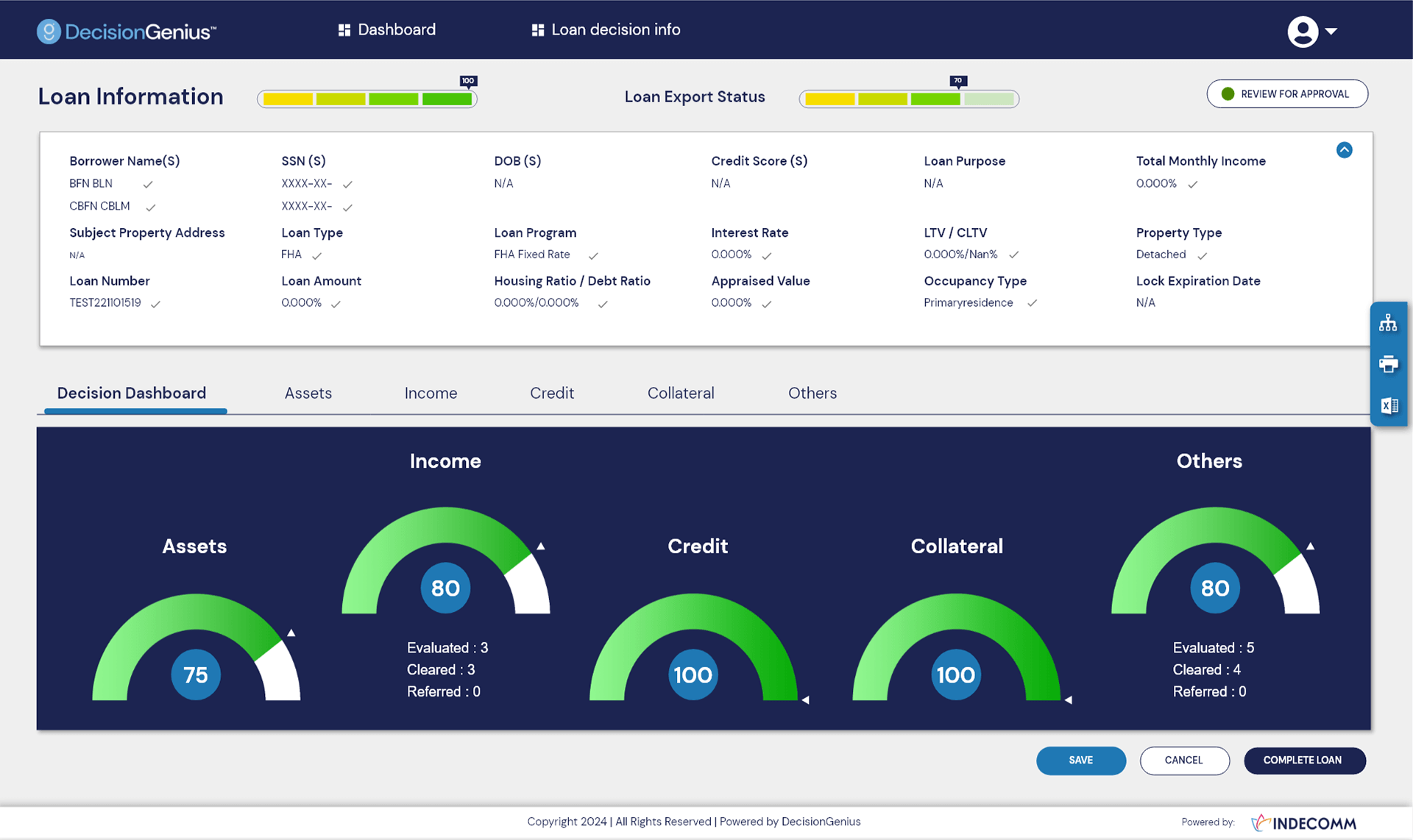

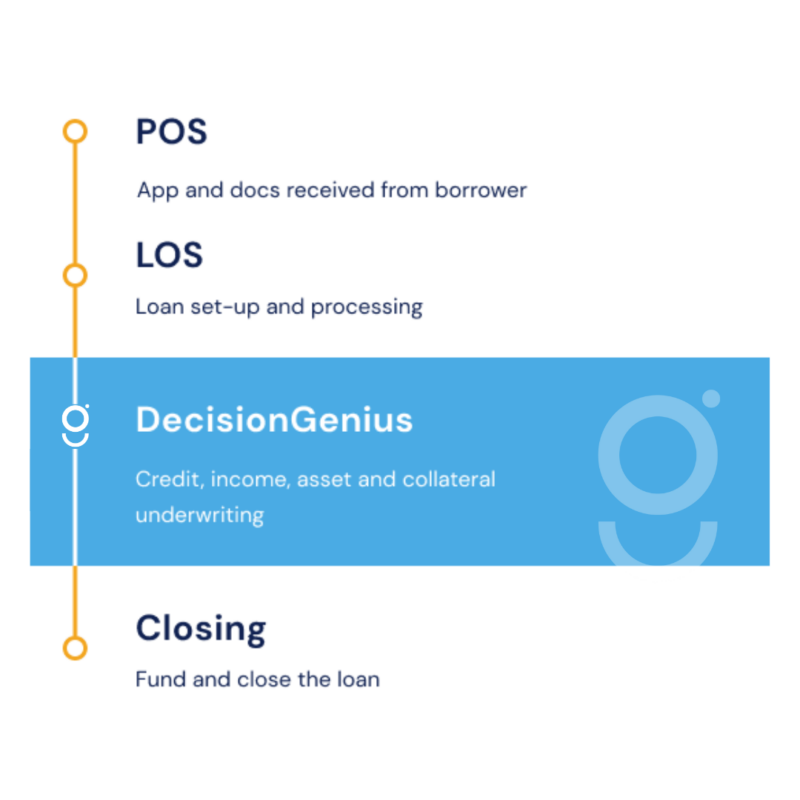

DecisionGenius, a mortgage underwriting automation and AI solution, delivers automated, risk-based decisions across the four pillars of mortgage underwriting: credit, assets, income, and collateral. Instead of spending hours sorting through mortgage data and documentation, DecisionGenius leverages automation and AI to quickly compile and analyze all available information in one centralized location. As a result, your processors and underwriters gain a complete view of risk, enabling faster, more informed loan and credit decisions. DecisionGenius is an AI and automated mortgage underwriting system that produces the following benefits:

- Improves loan officer productivity

- Helps mortgage processors and underwriters analyze more loans, faster

- Generates consistent, data-driven mortgage underwriting recommendations

- Reduces time spent on data verifications and validations