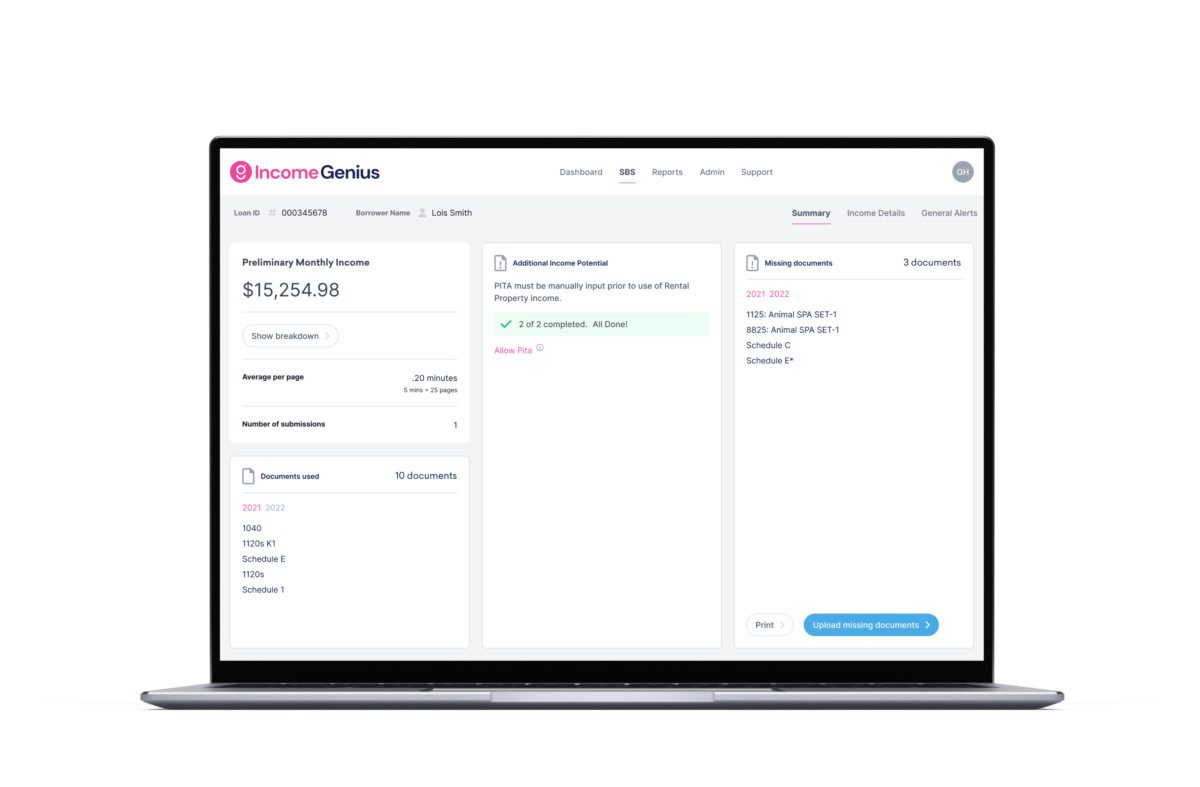

Simplify income calculations for your most unique customers

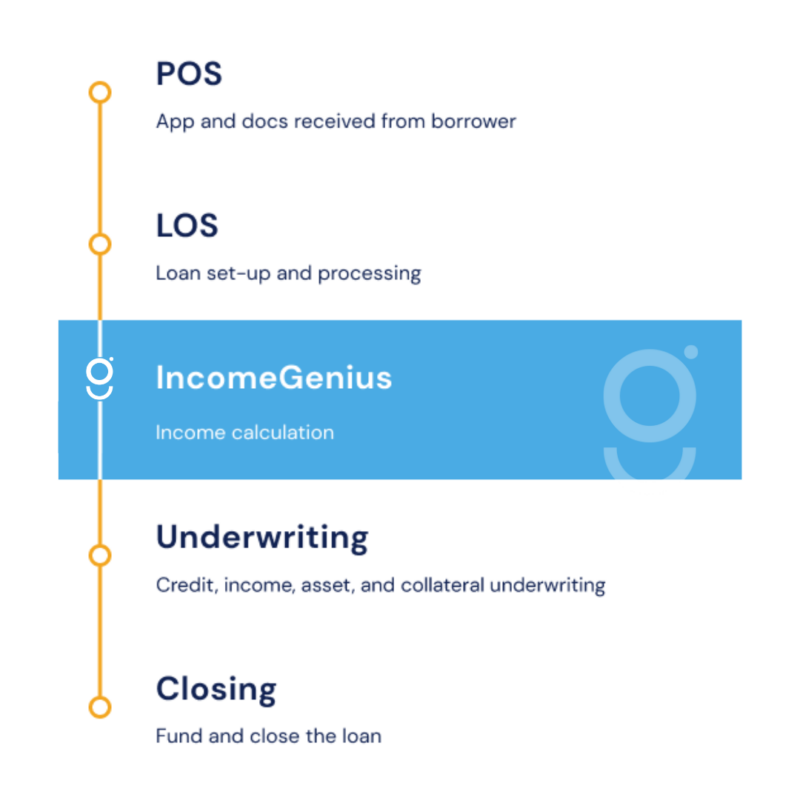

More and more borrowers are choosing self-employment, creating a growing need for flexible, accurate income analysis. IncomeGenius is a powerful tool designed for both wage earners and self-employed borrowers, leveraging AI and automation to deliver trusted income calculations, a consistent experience, and faster response times across all your home loan customers. IncomeGenius:

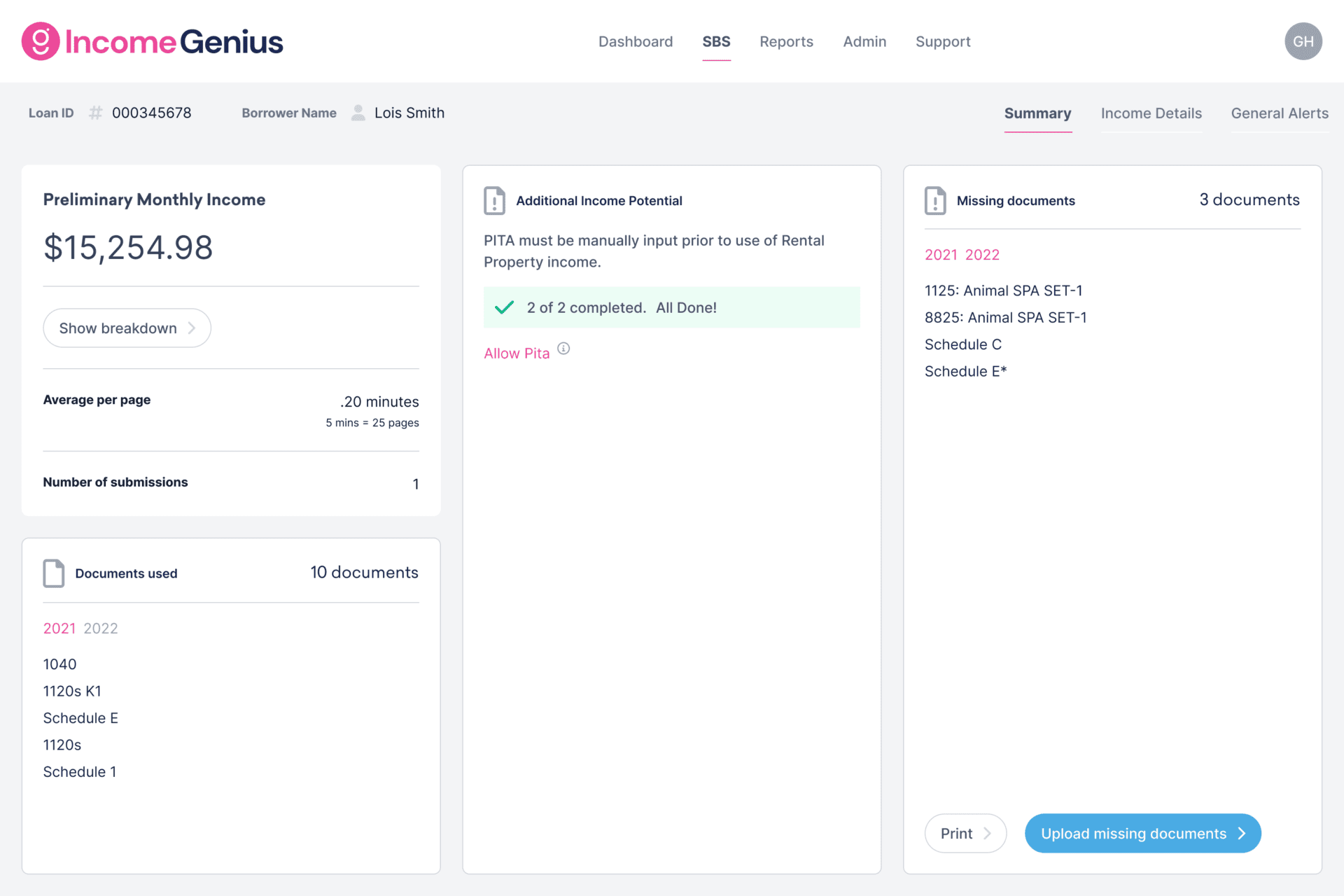

- Identifies and analyzes data and documents in record time

- Simplifies document-heavy, complex mortgage income analysis

- Verifies a complete loan file and flags missing data

- Meets compliance requirements and provides an audit trail

- Enables a consistent and fast borrower experience

- Utilizes AI for comprehensive data integrity checks