Resources

Get business resources and customer insights into the trends and solutions shaping the modern mortgage operation.

-

Article

Automation and AI in Underwriting: System Selection Simplified

Automation and AI in underwriting is no longer a luxury—it's an industry imperative. With rising demand for efficiency, reduced costs, and better customer experiences, automated underwriting systems (AUS) have taken center stage. Yet, navigating the process of selecting and adopting the right system can feel overwhelming. We've simplified it for you.

December 3, 2024 -

Article

Miscellaneous Madness: Why IDXGenius is Finally Making Mortgage Document Processing Painless

This, friends, is the mortgage industry’s document problem. It sounds like a minor inconvenience—something technology should have solved a decade ago. But here we are. At Indecomm, we’ve spent the last year digging into why this is still happening. The answer? While many vendors promise automated solutions for document indexing and data extraction, most fall short. Until now.

November 18, 2024 -

Article

Simplify Your Compliance with Indecomm’s Automated MERS Audit Solution

By focusing on efficiency, accuracy, and ease of use, Indecomm's Automated MERS Audit solution is an indispensable tool for lenders looking to streamline their compliance efforts. With this blog, you can clearly convey the value of the solution to potential clients, encouraging them to explore how Indecomm can simplify their audit processes

August 13, 2024 -

Article

Find Your Keys: Tackling Trailing Docs Tracking Post-Close

Beyond the timeliness of mortgage document delivery, issues with loan package quality can threaten the foundation of your post-closing operations. Rest assured, tackling trailing doc tracking is a non-issue with the right mortgage document technology.

July 22, 2024 -

Article

Meeting the Rising Demand for Mortgage QC Resources

Without adequate support, staying abreast of guideline changes, best practices in loan review, and ensuring compliance with new requirements becomes increasingly challenging, leaving mortgage companies vulnerable to fines and penalties.

April 24, 2024 -

Article

Evaluating Your Mortgage BPO Partner: Are they Your Ally or Frenemy?

In a marketplace filled with numerous mortgage BPO providers, it becomes crucial to distinguish those that genuinely add value. What are the most important features of your BP partner? How do you determine whether your partner is an ally, advancing your interests, or simply focused on keeping your organization reliant on FTEs?

February 29, 2024 -

Article

Lock Your Rates Not Your Capacity.

As the buzz around declining mortgage rates begins to swell, lenders and servicers are facing a veritable jungle of rate locks, volumes, and customers. Conjuring up the Wizard of Oz, the industry is trekking along its own Yellow Brick Road, where the thrill of increased loan volumes comes with a side of apprehension. This isn't just about enthusiasm; it's about readiness and business scalability. When the market returns with volume spikes, the fear of being unprepared can dampen the excitement of growth.

January 17, 2024 -

Article

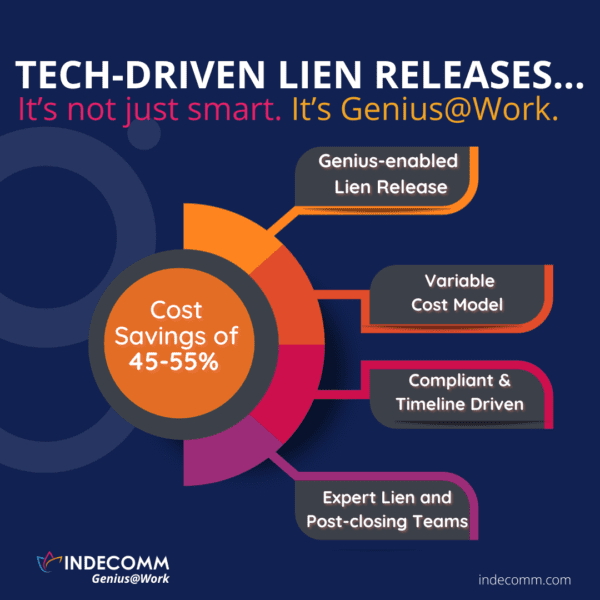

Tech-enabled Lien Releases: So Simple It’s Genius.

Picture this: you're in the business of mortgage lending, and you've just successfully helped a borrower close on their dream home. It's a moment to celebrate, but there's one more task on the to-do list -- releasing the lien on the property. Now, you could handle this the old-fashioned way, diving into stacks of paperwork, crossing your fingers, and hoping for a smooth process. Or, you could take a cue from Indecomm's Genius approach to mortgage operations and simplify. Enter lien release services - the streamlined, no-nonsense approach to ensuring that all-important lien is released efficiently and in compliance with all the rules and regulations. Here's how Indecomm can help you cut through the complexity:

November 9, 2023 -

Article

The Art & Science of Sustainable Mortgage Innovation

The mortgage market is predictably unpredictable. If you are a mortgage industry veteran, you have ridden the mortgage rollercoaster and watched businesses exit never to return. The truth is that not every firm is cut out for (or designed to withstand) the fast, extreme market change that can occur in the mortgage industry.

September 29, 2023 -

Article

Unconventional Wisdom: Mortgage Outsourcers Should be Willing to Automate Their FTEs Out of the Process

The Indecomm mortgage services model gives its partners a pathway to automation and tech adoption. It has flipped the script on the traditional mortgage outsourcing model and prioritized the lender and servicer's need for a high-tech, automation-enabled services offering.

September 11, 2023 -

Article

Striking a Balance with Augmented Underwriting

The mortgage industry's transformation is underway, driven by the convergence of technology and human expertise. Augmented underwriting emerges as a beacon of change, where automation enhances efficiency, accuracy, and the borrower experience. As lenders navigate this dynamic landscape, embracing augmented underwriting can unlock untapped potential, deliver faster approvals, and secure a competitive edge. But what is it and how does it work?

August 28, 2023 -

Article

Close Encounters of the Mortgage Underwriting Kind

It may not be science fiction but underwriting a mortgage loan is an epic quest for the truth that involves pouring over hundreds of documents, checking fields, comparing calculations, and often, going over the same file several times.

July 5, 2023